Signs of the times

Over the past 10 months, EconomyStory.org has featured some of the most poignant, informative and visual stories about communities coping in the ongoing crisis.

These stories are what make public media stand out – the voices featured from around the country and the innovative ideas that have inspired news stories.

It’s been so exciting to learn how the economy has changed over the past year – at times the stories have been hopeful and uplifting, often they’ve been upsetting and grim, but never boring.

Here’s a quick review of a few stories that continue to be relevant:

Book Club (4/12/2010) and Book Keeping (3/11/2010) Funny names of old financial texts, and a Paul Solman list of the best books on the financial crisis.

One Sixth of What? (9/22/2009) Back in September, before the health care reform legislation was passed, we examined what makes up the health care costs.

Trading Up (2/24/2010) looked at bartering’s comeback – from help with school projects to borrowing a rake from your next door neighbor.

Shifting Gears (4/2010): Tens of thousands of people work building vehicles in the U.S. And while Ford and GM are reporting that their books look better, many people are still riding the waves of the the hard transition in this industrial sector. That’s why Shifting Gears, a public radio special, will have relevance for some time to come. The latest EconomyBeat podcast features highlights from the program.

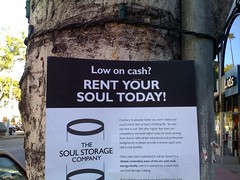

Pictures of Transition: One of the most popular aspects of the EconomyBeat.org blog this past year was the weekly collection of user-generated images about the state of the economy. These powerful, witty and painful pictures illustrate the compelling drama of the recession that communities and individuals continue to navigate.

I can’t write about EconomyStory without including stories that came directly from readers, listeners and viewers in the form of comments, six-word memoirs and responses on Facebook and Twitter.

A comment from reader Carlos Tobin about bank size, one of many active discussions on Facebook:

Limiting the size of banks could hurt a innovative start up bank that wants to form and take out the banks that caused the problem. Legislation will just entrench the existing players, and stifle innovation.

And the Six-Word Memoir Project with SMITH Magazine, which collected creative tales of economic hardship. The most recent ones, posted on the SMITH site include:

Whitney Cole: Goodbye, economy. Hello, credit card debt.

Charles: Exchanged credit cards for library card

Kali: Buying a camper, not a house!

EconomyStory will continue to serve as a jumping off point for exploring all that public media has to offer. Projects like Patchwork Nation and Youth Radio aren’t going away, so the links on this site will still take you to the best coverage of the economy. However, as the EconomyStory collaboration comes to an end, this blog will no longer be updated. You can still follow the great work that the Public Radio Exchange (PRX) does at PRX.org and you can follow my work on Twitter @laurahertzfeld. Thank you for all your support and input! And a big thank you to the Corporation for Public Broadcasting (CPB) for making this possible.